It’s been nearly a month since the event that jolted headlines: the capture of Nicolás Maduro and the resulting shift in control over Venezuela’s oil resources. That moment was dramatic, but what followed matters even more for markets, investors, and everyday financial logic. Instead of looking at that event in isolation, 2026 is shaping up as a year where structural change — not an isolated shock — may determine how Venezuelan oil intersects with global energy dynamics.

Revisiting the Scenario: From Shock to Structural Discussion

In early 2026, international attention turned to Venezuela not just because of political upheaval, but because the world briefly saw the possibility of a large swing in oil supply. Venezuela holds the world’s largest proven oil reserves — about 303 billion barrels — yet currently produces far less than its capacity due to decades of underinvestment and sanctions.

Since then, production has begun slowly rising again as wells are reopened and exports resume under new oversight. Agreements with the United States to market Venezuelan crude have yielded millions of barrels shipped, albeit at a slower pace than initially promoted.

This transition from immediate shock to operational reality is where the real story begins.

Structural Changes in Venezuela’s Oil Sector

A striking development in January has been the legislative push to overhaul Venezuela’s hydrocarbons framework — arguably the most significant since the nationalizations of previous decades.

The proposed reforms aim to:

- Allow private and foreign companies to operate oilfields with greater autonomy and to market production directly, breaking decades of state-controlled monopoly.

- Introduce production-participation contracts that provide flexibility in revenue sharing.

- Potentially reduce royalty and tax burdens for investors in economically challenging fields.

- Legally embed features of the Anti-Blockade Law into the foundational hydrocarbons regime, aiming to offer legal certainty for existing and future contracts.

The intent is clear: after years of underinvestment, Venezuela is repositioning its legal framework to attract capital— in some cases backed by expectations of substantial investment growth in 2026.

Yet these reforms are uneven and contested, with critics warning that vague language and legislative pushback could limit the confidence of potential large-scale investors.

How Markets Price Risk and Oil Supply Now

Markets don’t simply react to supply and demand curves — they ping on expectations, legal certainty, and perceived risk. In the weeks following the shock event, global oil prices initially showed volatility, but recent trends have reflected the deeper reality of oversupplied markets and geopolitical pressures beyond Venezuela alone.

Even with these structural discussions, Venezuela accounts for only a small portion of global production at present. Analysts project that even with a political and legal turnaround, production might only climb modestly over the next few years — perhaps reaching around 1.3–1.4 million barrels per day, up from under a million today.

What this means for markets is not a dramatic swing in oil prices, but a recalibration of risk premia — the small but persistent valuation markets place on uncertainty regarding future supply, legal frameworks, and investment flows.

Consequences for Investors, Consumers, and Commodities

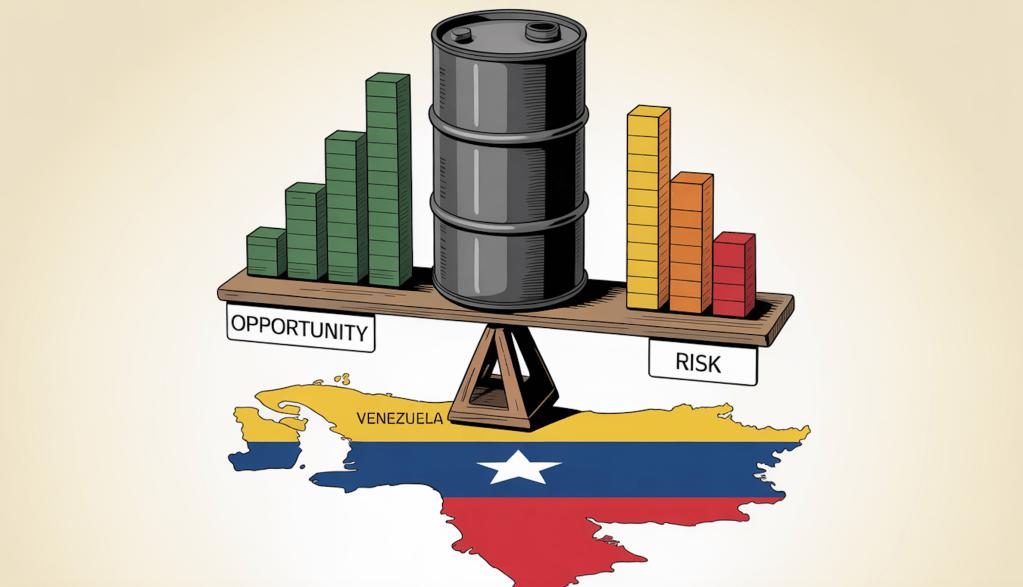

From an investor’s perspective, this transitional phase highlights two realities:

- Opportunity exists, but it’s contingent on legal clarity and structural stability. Without a reliable investment framework, anticipated capital inflows may remain smaller and slower than policymakers hope.

- The broader energy market is not dependent on Venezuela alone. Renewable energy trends, U.S. shale output, and broader OPEC strategies continue to play dominant roles in pricing and supply expectations.

For everyday consumers, higher-level geopolitical shifts can influence fuel prices, inflation expectations, and regional energy dynamics — but rarely in direct, immediate ways. What matters more is how these structural shifts influence long-term investment, infrastructure spending, and regulatory certainty in energy markets.

What 2026 Signals for Energy Transition and Geopolitics

The Venezuela episode that began with volatility has evolved into a nuanced test case of how energy markets balance risk, legal reform, and structural change.

Even if Venezuela never regains its historical levels of production, the reforms it pursues — and how swiftly and credibly it implements them — say a lot about:

- How oil-rich nations might restructure in a world of energy transition

- How legal frameworks compete with political instability in attracting capital

- How markets evaluate potential supply shifts versus actual output

Venezuela may no longer be the powerhouse it once was, but this year’s developments provide a lens into broader patterns: how markets price future expectations, and how legal change can matter as much as physical barrels.

In that sense, 2026 might not be a year of dramatic recovery — but of quiet, foundational transformation in how energy and investment intersect on the global stage.

References

- Reuters, Venezuela’s oil reform met with flurry of proposed changes, 2026.

- Reuters, Venezuelan oil exports under U.S. supply deal progress slowly, 2026.

- JPMorgan, Venezuela oil outlook and global energy implications, 2026.

- S&P Global Commodity Insights, New Venezuela hydrocarbons law and production-sharing reforms, 2026.

- McKinsey Global Institute, Energy investment, risk and transition dynamics, 2025.

- Investopedia, Why oil markets price expectations, not just supply, updated edition.