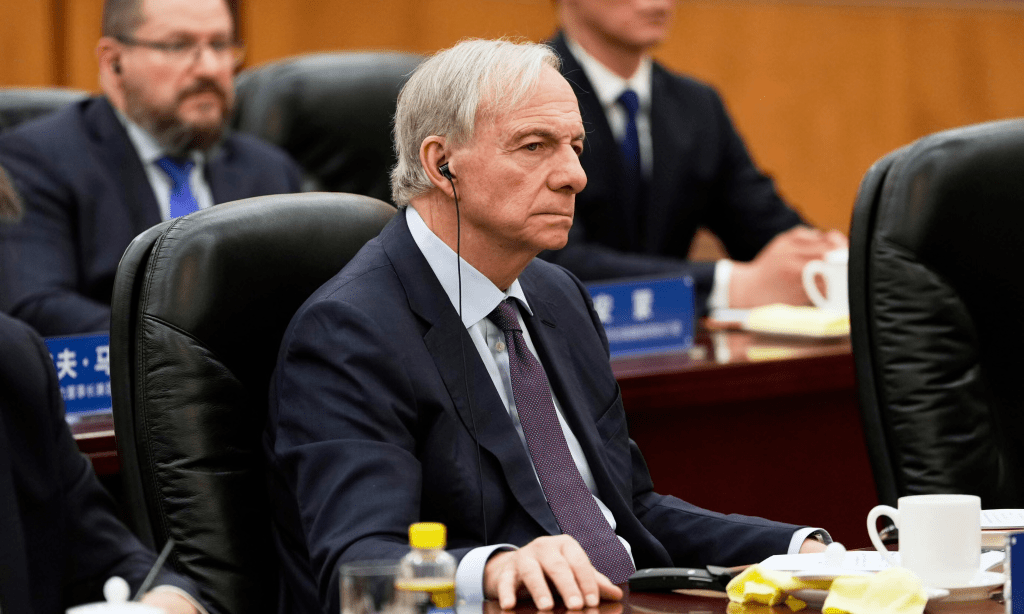

Ray Dalio, billionaire investor and founder of Bridgewater Associates, is once again sounding the alarm. Known for accurately predicting the 2008 financial crisis, Dalio now warns of a looming economic threat — one potentially more severe than a typical recession.

During an interview with NBC’s Meet the Press on April 13, 2025, Dalio shared deep concerns about the current state of global economics, citing rising U.S.-China trade tensions, increasing tariffs, and America’s mounting national debt as key risk factors. But what does this mean for your money, the tech market, and the global economy?

Why Dalio Is Worried: Core Economic Risks

1. A Broken Global Order

Dalio described the current global landscape as “disordered,” where rising protectionism and geopolitical instability are disrupting international cooperation. He likened the moment to key turning points in history — like the monetary system collapse of 1971.

“We are now in a period where the risks are bigger than just a traditional recession,”

— Ray Dalio, NBC Interview, April 13, 2025

2. Tariffs as a Threat to Economic Efficiency

Dalio criticized the aggressive tariff policies introduced under Donald Trump, warning that they’re akin to “throwing rocks in the gears of global productivity.”

Key Tariff Facts:

- U.S. has increased import duties on Chinese goods by up to 145%.

- China responded with its own retaliatory tariffs, targeting U.S. tech, agriculture, and automotive exports.

The result? A more expensive supply chain, slowed trade, and higher prices across industries.

3. The Rising National Debt

Dalio highlighted the unsustainable trajectory of U.S. fiscal policy. With national debt reaching record highs, he warned that the U.S. must reduce its deficit to 3% of GDP to avoid long-term structural collapse.

Impact on Markets and Investors

Stock Market Volatility

Following Dalio’s warnings and ongoing trade war escalations, markets responded with sharp declines:

- The Dow Jones dropped over 2,200 points in two days.

- More than $6.4 trillion in market value was erased.

- Tech and manufacturing stocks were hit hardest due to exposure to China.

Investor Behavior Shift

With fear rising, many investors are moving funds into:

- Gold and commodities

- U.S. Treasury bonds

- Defensive stocks like utilities and consumer staples

How Tariffs Affect Consumers and Businesses

For Consumers

- Price Inflation: Electronics, clothing, and everyday goods are expected to rise in price due to import taxes.

- Less Choice: As supply chains shrink, some products may disappear from shelves.

For Businesses

- Higher Production Costs: Companies reliant on Chinese components face immediate cost increases.

- Delayed Innovation: Uncertainty in trade slows R&D, especially in the tech sector.

What Can You Do Now?

1. Diversify Your Portfolio

Avoid overexposure to global equities. Mix in safer assets like U.S. bonds, dividend-paying stocks, and precious metals.

2. Follow Global Economic Trends

Stay updated with policy changes, trade agreements, and market signals from central banks and international agencies.

3. Build Financial Resilience

- Boost your emergency fund

- Reduce high-interest debt

- Delay non-essential large purchases

Ray Dalio’s warning is not a prediction of doom — it’s a call to be realistic and prepared. The current blend of geopolitical conflict, trade restrictions, and unsustainable debt creates a perfect storm that could shake the global financial system.

Whether you’re an investor, entrepreneur, or average consumer, the message is clear: now is the time to build financial resilience and pay attention. The future may hold more than just a slowdown — it could be a fundamental reshaping of the world economy.

Sources and References

- The Guardian – Ray Dalio warns Trump tariffs could trigger something worse than a recession

- CNBC – Billionaire Ray Dalio: I’m worried about something worse than a recession

- NBC News – Investor who predicted 2008 crisis fears something worse

- MarketWatch – Dalio: “U.S. economy dangerously close to collapse under rising tariffs”