After five years of pandemic-era relief, the U.S. Department of Education will resume collections on defaulted federal student loans starting May 5, 2025. This decision affects more than 5.3 million borrowers and is expected to reshape the financial lives of many Americans — especially those already struggling.

In this article, we break down the reasoning behind this move, its potential impact, and what you can do now to protect your finances.

💼 Why the Government Is Restarting Collections

The official explanation is fiscal responsibility. According to Education Secretary Linda McMahon:

“American taxpayers should not bear the cost of failed student loan policies.”

Collections will restart via the Treasury Offset Program, meaning:

- Tax refunds can be withheld

- Federal wages can be garnished

- Social Security benefits may be reduced

This signals a policy shift from the previous forgiveness-first approach of the Biden administration.

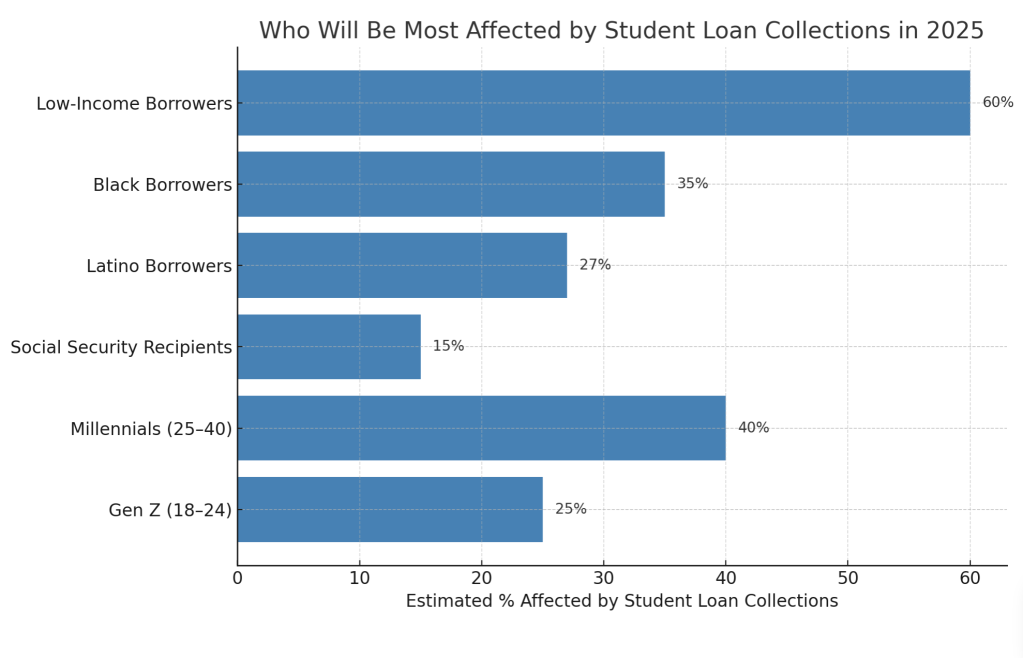

⚠️ Who Is Most at Risk?

Low-Income Borrowers

Living paycheck to paycheck, these individuals may not have the cushion to absorb wage garnishment or tax refund reductions.

Black and Latino Borrowers

Due to systemic inequalities, these communities often carry higher loan burdens and default rates.

Social Security Recipients

Many older borrowers will see their retirement income reduced.

Millennials and Gen Z

Younger generations are the most likely to be in default and have less financial literacy or stability.

💡 What Are Your Options?

Contact the Default Resolution Group

Start by visiting StudentAid.gov or calling the DRG for assistance.

Explore Income-Driven Repayment (IDR) Plans

These cap your payments based on income and can help pull you out of default.

Rehabilitate or Consolidate Your Loans

Rehabilitation removes the default status after 9 on-time payments. Consolidation is faster but keeps the default on your record.

✅ Pros and Cons of Restarting Student Loan Collections

Pros:

- Restores financial discipline to the system

- Reduces government deficit

- Encourages repayment culture

Cons:

- Hits vulnerable populations hardest

- May worsen credit scores and mental health

- Poor communication could lead to errors and chaos

📊 Who Will Be Most Affected?

Below is a visual breakdown of the groups most likely to feel the impact:

Image credit: Smart Money Tech, based on Brookings and SBPC estimates

Final Thoughts

This policy change may feel harsh — but it also signals a return to “normalcy” in federal loan operations. The key is to act before collections begin.

If you’re at risk, now is the time to explore repayment programs, negotiate your terms, or seek legal guidance if needed. Ignoring the problem will only worsen the financial hit.