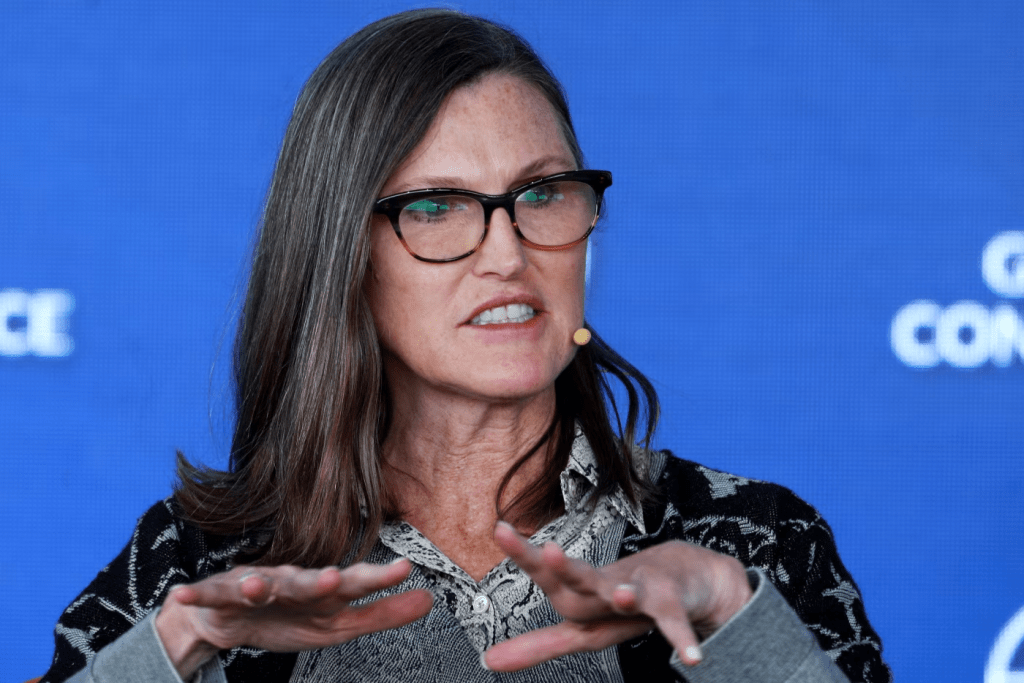

Photo: David Swanson / Reuters

Cathie Wood is not just an investor — she represents a futuristic mindset within an industry known for its conservatism. As the founder of ARK Invest, Wood gained the spotlight by betting on innovation when few dared to. Rather than follow trends, she anticipates them — and that’s exactly what made her one of the most influential financial voices of the past decade.

The Beginning of a Bold Journey

Cathie was born in 1955 in Los Angeles, California. Her father was a radar and aviation systems expert, which exposed her early on to the power of technology as a transformative force. She graduated in economics and finance from the University of Southern California, where she studied under renowned economist Arthur Laffer, creator of the famous “Laffer Curve.” This early exposure to visionary thinking shaped her investment philosophy.

Wall Street Years and the Birth of ARK

Before founding her own firm, Cathie worked for decades in finance, holding senior positions at firms like Jennison Associates and AllianceBernstein, with a focus on macroeconomic research and investment strategy. But it wasn’t until 2014 that she made her boldest move: launching ARK Invest — a firm focused exclusively on disruptive innovation.

At the time, many doubted the viability of a fund concentrated on technology, biotech, AI, blockchain, and electric vehicles. But Wood was resolute: she believed these industries would dominate the future — and she wanted to lead that movement.

Her Tesla Bet (and the Risks of Boldness)

It was her bold bet on Tesla that put Cathie Wood on the map. While many analysts remained cautious, Wood believed Elon Musk’s company would become one of the world’s most valuable — and she was right. The ARK Innovation ETF (ARKK) delivered incredible returns, becoming a reference point for retail and institutional investors seeking exposure to the future.

But boldness comes with volatility. ARK’s funds faced major downturns when markets shifted focus to value stocks and rising interest rates. Still, Wood stood firm in her convictions, maintaining positions and reinforcing her long-term vision.

A Vision Beyond Traditional Finance

Wood’s strategy goes beyond spreadsheets. She integrates themes like artificial intelligence, climate change, and genomic research into her analysis. This forward-thinking approach resonates with younger, tech-savvy investors hungry to understand the “why” behind investing. Her transparency — through livestreams, open research, and accessible commentary — has helped build a loyal following.

Critics and Controversy

Not everyone is sold on ARK’s methodology. Critics argue that her funds are too volatile and her forecasts too optimistic. But Wood has always embraced risk. “Disruption doesn’t happen with caution,” she has said in interviews.

Legacy and Impact

Regardless of market performance, Cathie Wood has already carved out her place in financial history. She proved that innovation can thrive even in the most traditional sectors. By championing emerging companies and democratizing investment knowledge, she has inspired a new generation of investors — especially women — to enter the space with confidence and vision.

References:

- ARK Invest Official Website – https://ark-invest.com

- CNBC Interview with Cathie Wood (2023)

- Bloomberg Profile – Cathie Wood

- Business Insider: “Why Cathie Wood is doubling down on innovation” (2024)