Oil Futures Are Spiking — Here’s Why It Matters

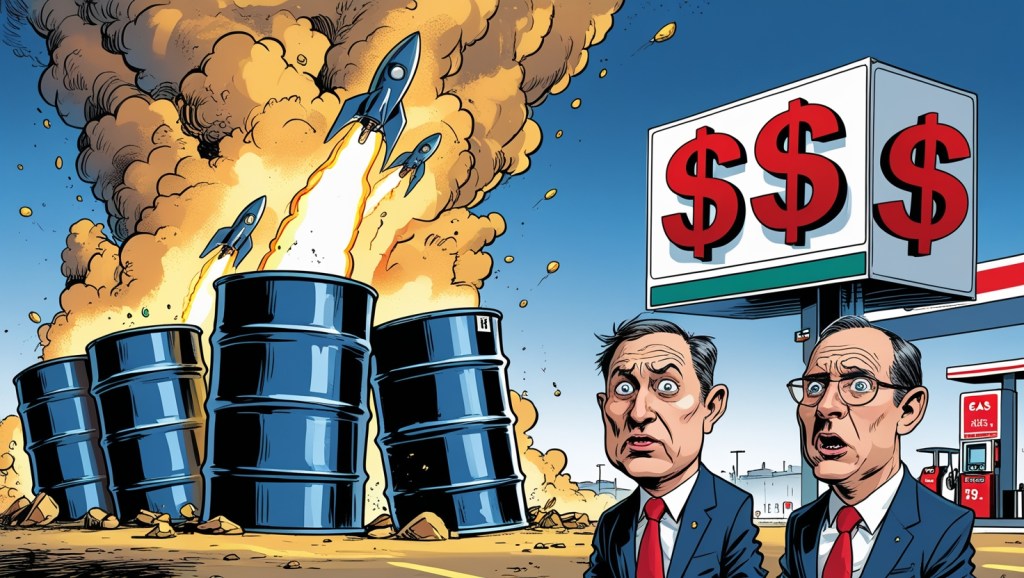

In the last 24 hours, “oil futures” saw a massive surge in search interest, jumping over 300% in the U.S. This isn’t just a headline for Wall Street traders — it’s a flashing warning light for your everyday budget, from gas prices to airline tickets.

But what exactly are oil futures, and why should you care? Let’s break it down.

What Are Oil Futures?

Oil futures are contracts that allow buyers to lock in the price of oil for a future date. They’re a key part of the commodities market, and they directly influence the cost of gasoline, diesel, shipping, and even food.

In plain English: when oil futures go up, it’s usually a sign that prices at the pump — and everywhere else — will soon follow.

Why the Price Spike Now?

This week’s surge in oil futures has been fueled by a potent mix of geopolitical tension and economic speculation:

- Middle East Instability: Any hint of conflict near major oil producers (like Iran or Saudi Arabia) sends prices skyrocketing due to fear of supply disruption.

- OPEC Production Cuts: The Organization of the Petroleum Exporting Countries (OPEC) has hinted at continued supply tightening.

- U.S. Strategic Reserves: The U.S. is still refilling its emergency oil reserves, pushing demand.

- AI and Algorithmic Trading: A lesser-known factor, automated trading bots are now triggering price rallies based on keyword volatility, not just fundamentals.

This isn’t just economics — it’s code, politics, and fear working together.

How It Affects You

Here’s where it gets personal. Rising oil futures almost always ripple into:

| Area | Impact |

|---|---|

| Gas Prices | Expect a $0.10–$0.30 increase per gallon soon |

| Air Travel | Ticket prices could spike by 5–10% |

| Groceries | Shipping costs may raise produce/meat prices |

| Energy Bills | Home heating and electricity could get costlier |

This is inflation 2.0 — and it’s creeping into your daily life.

Should You Invest in Oil?

Maybe — but tread carefully.

While oil ETFs and stocks (like ExxonMobil or Chevron) can benefit from rising futures, this is not a “get rich quick” scenario. Geopolitical events are notoriously volatile. One peace treaty or demand drop, and prices tumble.

Smarter Strategy: If you want exposure, consider diversified energy ETFs or sustainable alternatives like clean energy funds — which often rise when fossil fuel prices scare consumers.

Conclusion: Don’t Just Watch Oil, Watch the Whole System

The spike in oil futures is more than a trader’s drama — it’s a signal of how vulnerable our economy is to shocks. Whether you’re investing, budgeting, or planning your next trip, now’s the time to keep a close eye on this invisible fuel that powers everything.

🛢 Want to track oil prices in real-time? Bookmark platforms like TradingView, Investing.com, or the Bloomberg Commodities Index.

References

- CNBC, “Oil prices rise amid Middle East tensions,” 2025.

- Bloomberg Markets, “OPEC eyes further cuts,” 2025.

- U.S. Energy Information Administration, Data Reports, 2025.