From a Golf Caddy to Wall Street Titan

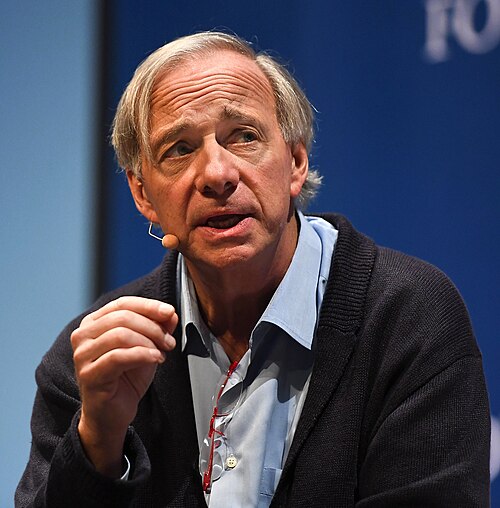

Ray Dalio didn’t grow up surrounded by financial privilege. Born in Queens, New York, he started investing at age 12 by buying shares of Northeast Airlines with money earned caddying. By 26, he founded Bridgewater Associates from his apartment, which would later become the world’s largest hedge fund. Dalio’s story is not just about success — it’s about process, discipline, and deeply rooted principles.

Principles First: How Dalio Thinks About Money

Dalio’s most famous work, Principles, outlines the mental frameworks that guide his decisions — not just in finance, but in life. He believes in radical transparency, meritocracy, and learning from failure. According to Dalio, mistakes are the seeds of learning, and having clear principles allows you to make better decisions consistently.

“Pain + Reflection = Progress” — Ray Dalio

This thinking applies to your wallet, too. If you’ve made financial mistakes, what matters most is your ability to reflect and evolve.

Applying Dalio’s Thinking to Personal Finance

You don’t need to manage billions to benefit from Dalio’s mindset. Here’s how you can apply his principles:

- Have a clear plan: Dalio constantly stresses clarity. Whether it’s budgeting or investing, write your plan down and stick to it.

- Track and reflect: What worked? What didn’t? Analyze your spending the way Dalio analyzes his trades.

- Diversify smartly: Dalio’s famous “All Weather Portfolio” is designed to withstand any economic climate. Diversification isn’t just a buzzword — it’s a survival strategy.

- Think in probabilities, not guarantees: No outcome is certain. Prepare for a range of outcomes and stay flexible.

His Legacy Beyond Markets

Today, Dalio spends much of his time on global macro research and philanthropy. He often speaks about the long-term cycles that shape history, including inequality, debt, and political conflict. For investors and ordinary people alike, he encourages lifelong learning and awareness of bigger systems.

“He who lives by the crystal ball will eat shattered glass.”

Recommended Reading (Affiliate Link)

If you want to go deeper into Ray Dalio’s philosophy, start with his book Principles: Life and Work. It’s a mix of autobiography, business manual, and self-improvement guide.

Your Portfolio Needs a Philosophy

Ray Dalio teaches us that investing isn’t just about numbers — it’s about systems, mindset, and discipline. Whether you’re starting from scratch or already building wealth, having clear principles is your greatest asset. The sooner you define yours, the stronger your financial decisions will become.

Start small. Think big. Reflect often. That’s the Dalio way.