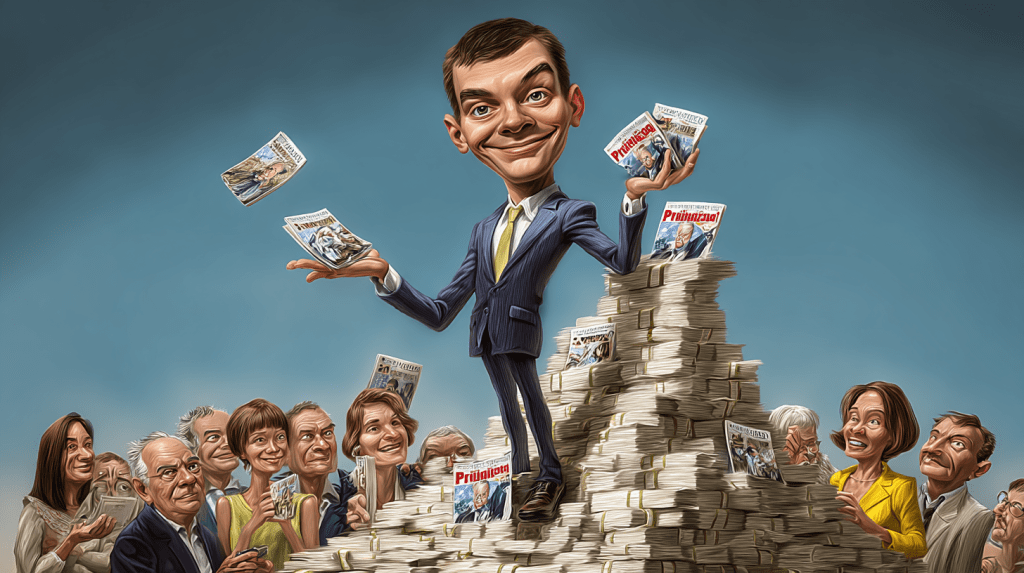

The Company No One Talks About — But Everyone Knows

In the flashy world of Wall Street, some companies dominate headlines while others quietly dominate the market.

Primerica, a 45-year-old financial services firm based in Georgia, falls into the latter category.

You’ve probably never seen its commercials during the Super Bowl.

But you’ve almost certainly met someone who’s tried to recruit you to join it.

Despite flying under the radar, Primerica (NYSE: PRI) serves more than 5 million clients, manages over $100 billion in life insurance coverage, and has built one of the largest financial sales forces in North America.

Yet its business model divides opinions sharply — is it a financial empowerment machine or a modern-day pyramid?

How Primerica Makes Its Money

Primerica’s model is deceptively simple:

It recruits independent representatives to sell life insurance, mutual funds, loans, and retirement products to middle-income families.

The company’s slogan, “Buy term and invest the difference,” embodies its mission to educate everyday Americans about affordable coverage and long-term investing.

Here’s where it stands out — or gets controversial:

Representatives are not employees, but independent contractors who earn commissions on products sold and bonuses for recruiting others to join.

This dual-structure makes Primerica resemble multi-level marketing (MLM) more than a traditional financial firm.

The Numbers Behind the Empire

| Metric | Primerica (2025) | Comparison |

|---|---|---|

| Clients served | 5.7 million | Comparable to Charles Schwab retail division |

| Life insurance in force | $100B+ | Above average for non-institutional insurers |

| Active representatives | 130,000+ | Among the largest in North America |

| Revenue (TTM) | $2.9 billion | Up 7% YoY |

| Net income margin | ~18% | Higher than many peers in financial services |

These numbers show a company that’s not only surviving — it’s thriving.

Its growth is driven by grassroots recruitment and a loyal base of middle-income clients who view the company as a gateway to financial literacy.

The Pyramid Debate: Empowerment or Exploitation?

Critics argue that Primerica’s business model blurs the line between financial education and recruitment-driven profit.

While legitimate in structure — Primerica is publicly traded, regulated, and licensed — its reliance on recruiting downlines to expand sales raises ethical concerns.

Former representatives claim that the income potential is overhyped, with most recruits earning little or nothing after fees and training costs.

On the other hand, defenders insist that Primerica provides real financial literacy, affordable insurance, and a unique path for individuals without traditional finance backgrounds to build a business.

Both can be true: the opportunity exists, but it’s not equally profitable for everyone.

Why It Keeps Growing Anyway

Primerica’s staying power can be explained by three key factors:

- Mass-market focus — It targets the “forgotten middle class,” an audience often ignored by Wall Street.

- Trust through relationships — People buy financial products from friends, family, and community — not apps. Primerica’s human network is its moat.

- Low capital risk — By using independent contractors, Primerica scales without the overhead of a traditional financial firm.

It’s a model that’s hard to replicate and easy to underestimate.

Investment Perspective: The Stock That Quietly Delivers

Primerica’s stock (PRI) is up over 60% in the past 5 years, outperforming several major insurers.

Its dividend yield (~1.3%) and consistent earnings make it a steady compounder — not flashy, but reliable.

For long-term investors, Primerica offers something rare: a boring business that works.

Its hybrid of financial services and network distribution could even serve as a model for future fintechs targeting the underserved.

Conclusion: The Fine Line Between Empowerment and Exploitation

Primerica is a paradox — part financial educator, part recruitment machine.

Its critics see manipulation; its advocates see opportunity.

But one thing is undeniable: it has tapped into a market Wall Street ignored, helping millions of Americans access basic financial tools.

Whether you see it as empowerment or exploitation depends on which side of the presentation table you’re sitting on.

References

- Bloomberg, Primerica Earnings and Market Overview 2025.

- Forbes, Is Primerica a Pyramid Scheme? A Deep Dive into Its Business Model., 2024.

- CNBC, Why Middle-Class America Still Buys from Primerica., 2025.