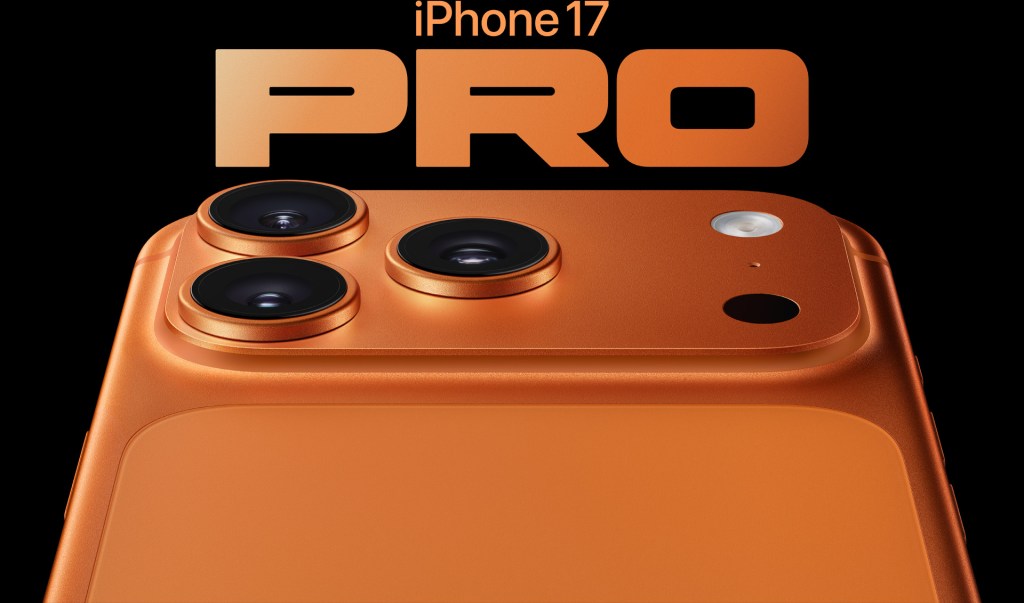

The Hype Behind the Launch

Every September, Apple sets the stage for the most anticipated tech event of the year: the new iPhone reveal. The iPhone 17 continues that tradition, bringing together cutting-edge hardware, refined design, and an even deeper integration with Apple’s ecosystem. Expectations were sky-high, and Apple’s latest flagship has already sparked debate in both the tech and financial worlds.

But beyond the buzz, what really changed? Let’s break it down.

Design and Display

Apple has refined the design of the iPhone 17, introducing slimmer bezels and a lighter titanium frame that feels premium yet durable. The device is slightly thinner than the iPhone 16, while still maintaining structural rigidity.

- Display: A new ProMotion XDR display with even higher brightness levels and improved color accuracy.

- Sizes: Available in the standard 6.1-inch and the larger 6.7-inch “Pro Max” versions.

- Durability: Enhanced Ceramic Shield 2.0 glass, promising better scratch and drop resistance.

The end result? A phone that looks and feels like the future while staying true to Apple’s minimalist design philosophy.

Camera Upgrades

For many, the camera system is the deciding factor—and the iPhone 17 does not disappoint.

- Main Camera: A new 48MP wide sensor with larger pixels for improved low-light performance.

- Telephoto (Pro models): Expanded periscope zoom lens offering up to 6x optical zoom.

- Video: ProRes video recording now supports 8K at 30fps, making the iPhone a professional filmmaker’s tool.

For content creators, the iPhone 17 pushes the boundary between a smartphone and a professional camera setup.

Performance and Chip

At the heart of the iPhone 17 is the A18 Bionic chip, Apple’s most powerful processor to date.

- CPU & GPU: Faster by up to 20% compared to the A17, with major improvements in efficiency.

- AI Processing: Enhanced Neural Engine, designed to optimize on-device AI tasks like photo editing and Siri’s contextual responses.

- Gaming: Console-level graphics performance thanks to ray tracing improvements.

Early benchmarks suggest that Apple continues to dominate the smartphone performance race.

Battery and Charging

Apple claims the iPhone 17 offers up to 2 extra hours of battery life compared to the iPhone 16.

- Charging: MagSafe charging speeds have been increased, and USB-C with Thunderbolt support (on Pro models) allows faster data transfers.

- Battery health: New software tools help users manage charging cycles to extend long-term performance.

Software and iOS Exclusives

The iPhone 17 launches with iOS 19, bringing new features that are exclusive—at least for now—to Apple’s latest hardware.

- Dynamic Island 2.0: Expanded functionality for multitasking and third-party apps.

- AI-Powered Features: Smarter photo categorization, on-device transcription, and improved Siri.

- Security: Upgraded Face ID with better performance in low light and support for horizontal unlocking.

These features ensure that iPhone 17 users get the most seamless and integrated experience possible.

Price and Availability

- Starting Price: $999 for the base model, $1,199 for the Pro, and $1,399 for the Pro Max.

- Availability: Pre-orders began immediately after Apple’s keynote, with shipping expected within two weeks.

- Colors: A refreshed palette, including Midnight Black, Silver, Titanium Blue, and a new “Sunset Gold.”

Apple has kept its premium pricing strategy, but the upgrades aim to justify the cost.

Final Verdict: Is It Worth the Hype?

The iPhone 17 is not a radical reinvention, but rather a polished evolution that strengthens Apple’s dominance in the premium smartphone market. The upgrades to the display, camera, and performance are significant enough to tempt those with older iPhones, though iPhone 16 users may hesitate to upgrade immediately.

For investors, Apple continues to prove its ability to create products that spark mass adoption and consumer loyalty. For consumers, the iPhone 17 represents one of the most refined smartphones ever released.

References

- Apple Keynote Event, September 2025.

- MacRumors, iPhone 17 Hands-On Review, 2025.

- The Verge, First Impressions of the iPhone 17, 2025.

- CNET, iPhone 17 Camera and Performance Analysis, 2025.