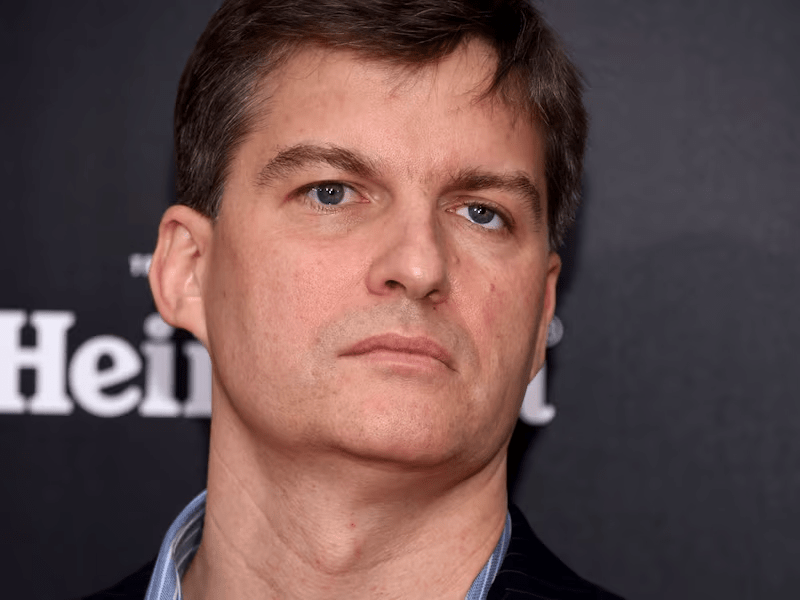

In the intricate world of finance, few names resonate with a sense of foresight and fearless conviction like Michael Burry. A trained physician turned legendary investor, Burry is best known for predicting the 2008 subprime mortgage crisis — a financial disaster that shook the global economy. His incredible journey from an outsider to a Wall Street icon remains a powerful example of how deep analysis and independent thinking can change the course of history.

Early Life and Career Transition

Michael James Burry was born in 1971 in San Jose, California. Despite facing challenges like losing an eye to cancer at a young age, he excelled academically and pursued a medical degree from Vanderbilt University School of Medicine. While completing his medical residency at Stanford, Burry spent his free time passionately studying financial markets and value investing.

His interest in finance grew so strong that he eventually left medicine altogether to focus on investing full-time — a bold decision that would later reshape his destiny.

The Birth of Scion Capital

In 2000, Burry founded his hedge fund, Scion Capital, using his own savings and funds from family and friends. Right from the start, Burry demonstrated an extraordinary talent for spotting undervalued investments. His investment philosophy was heavily influenced by Benjamin Graham (author of The Intelligent Investor) and Warren Buffett. He focused on deep fundamental analysis, seeking assets that were mispriced by the market.

Within a few years, Scion Capital delivered impressive returns, consistently outperforming major market indexes — but it was his audacious bet against the U.S. housing market that would make history.

The Bold Bet Against the Housing Market

In the mid-2000s, while the U.S. economy was booming and real estate prices were skyrocketing, Burry noticed troubling patterns in mortgage-backed securities (MBS).

After meticulously analyzing the underlying loans, he realized that a significant portion of mortgages — especially subprime loans — were likely to default as adjustable rates reset.

Burry made a radical move: he purchased credit default swaps (CDS) to bet against these risky mortgage bonds. At the time, Wall Street viewed him as eccentric, even foolish. Many investors in his fund pushed back, unable to see the storm he foresaw.

Yet, as history shows, Burry was right. When the housing bubble burst in 2007–2008, Scion Capital profited massively, earning hundreds of millions of dollars for his investors — and solidifying Burry’s reputation as a financial visionary.

Popular Culture: “The Big Short” and Burry’s Legacy

Michael Burry’s story gained global recognition through the book “The Big Short” by Michael Lewis, published in 2010.

Later, the story was adapted into the acclaimed 2015 movie “The Big Short”, where Burry was portrayed by actor Christian Bale.

The film showcased his meticulous research, his struggles to convince others, and his unwavering commitment to data over popular opinion.

Burry’s portrayal in “The Big Short” highlighted key aspects of his personality:

- His social awkwardness.

- His obsessive attention to detail.

- His resilience in the face of overwhelming skepticism.

The movie went on to win an Academy Award, further embedding Michael Burry’s place in modern financial folklore.

Life After the 2008 Crisis

After closing Scion Capital in 2008, Burry took time off but later returned to investing by opening Scion Asset Management.

Since then, he has continued making bold predictions and investments:

- Warning about market bubbles (including in tech stocks and cryptocurrencies).

- Expressing concerns about government debt and monetary policy.

- Investing in water assets, believing that water scarcity will be a major global issue.

Despite his media fame, Burry remains a deeply private individual, often communicating through sparse public statements and, occasionally, cryptic social media posts.

Lessons from Michael Burry’s Story

- Independent Thinking Pays Off: Following the crowd rarely leads to exceptional results.

- Deep Research Matters: True opportunities often lie beneath the surface.

- Patience Is Critical: Conviction can require enduring long periods of doubt and resistance.

- Risk Management Is Key: Betting against a system is dangerous — but with precise research and discipline, it can be rewarding.

Conclusion

Michael Burry’s journey from a medical resident to a financial legend reminds us that true insight often requires courage to stand alone. His prediction of the 2008 financial collapse not only changed his life but also altered the way many investors view market risks.

In a world increasingly driven by trends and noise, Burry’s example of rigorous analysis, independent thought, and unshakable patience remains more relevant than ever.

Michael Burry isn’t just a man who got lucky once — he’s a living testament to the power of questioning consensus and trusting in thorough, uncomfortable truths.