In April 2025, a federal judge ordered Bank of America to pay $540.3 million to the Federal Deposit Insurance Corporation (FDIC) in a long-standing legal battle. While this might seem like just another headline involving big banks, the implications go far beyond corporate boardrooms.

This case sheds light on banking practices, investor protection, and how financial institutions manage risk — and yes, it matters to your financial life too.

What Happened with Bank of America?

Background of the Case

The lawsuit stems from the bank’s role in managing securities during the 2008 financial crisis. According to the ruling, Bank of America overcharged investors in a set of failed mortgage-backed securities transactions, which ultimately led to massive losses for the FDIC as receiver of failed banks.

The Ruling

- Amount: $540.3 million

- Plaintiff: Federal Deposit Insurance Corporation (FDIC)

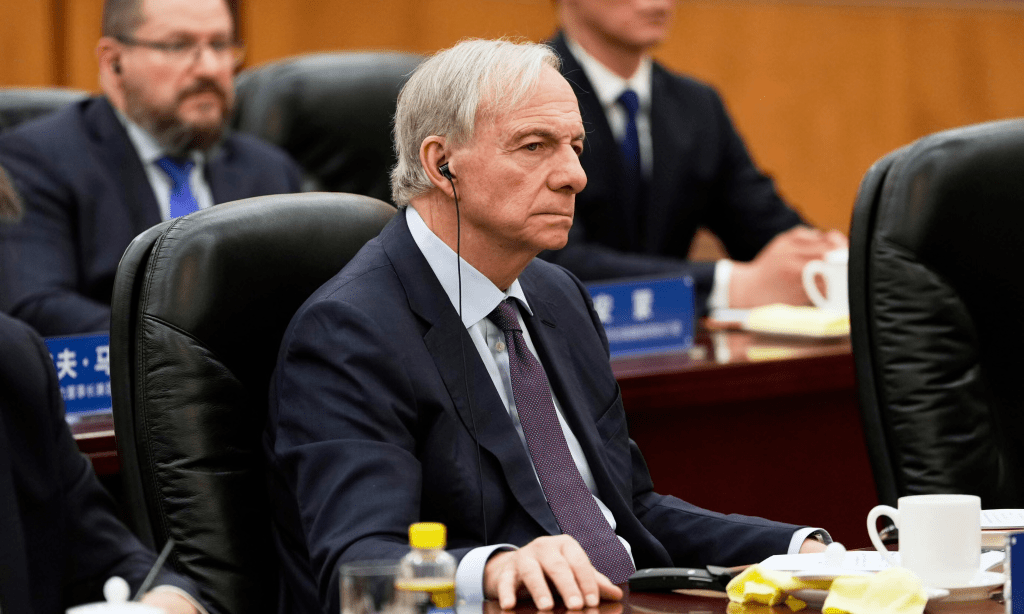

- Judge: Jed Rakoff, Southern District of New York

- Decision: The court found Bank of America liable for breach of contract and fiduciary duty.

The decision marks a significant win for regulators seeking accountability from big banks for past misconduct.

⚖️ Why This Matters (Even If You’re Not a Shareholder)

1. Signals Stronger Regulatory Oversight

This ruling sends a message to the financial sector: accountability is back on the table. Regulators are under pressure to enforce transparency and ethical practices in banking, especially in a time of economic uncertainty.

2. Impacts Consumer Trust

When one of the biggest U.S. banks is penalized for misconduct, it affects how much trust people have in the financial system. This may influence how consumers choose where to save, borrow, and invest.

3. Potential Changes to Banking Fees and Lending

Banks often pass on legal and compliance costs to their customers. While not immediate, this ruling could lead to:

- Tighter lending conditions

- Increased banking fees

- Stricter terms for retail banking products

4. It Can Influence Your Investments

If you invest in bank stocks, ETFs, or mutual funds, this case might affect your portfolio:

- BOA stock could face temporary volatility

- Financial sector ETFs might rebalance their holdings

- Investor sentiment around U.S. banks could shift short-term

Lessons for Everyday Investors

1. Read the Fine Print

Always understand the terms and risks associated with your investments. Even “safe” institutions can be vulnerable.

2. Diversify Your Exposure

Don’t put all your eggs in one sector or one stock — diversification protects you from shocks like these.

3. Stay Informed About Regulation

Following regulatory news can help you anticipate changes in market behavior, interest rates, or banking products.

What Happens Next?

- Appeal Potential: Bank of America may seek to challenge the ruling in higher courts.

- Stock Reaction: Investors are watching closely how this affects BOA’s stock and dividend performance.

- Broader Impact: Other banks under scrutiny may face similar legal action or internal reforms.

Conclusion: More Than Just a Fine

This isn’t just a legal slap on the wrist — it’s a clear signal that financial institutions must operate with integrity, or face major consequences. For consumers and investors alike, it’s a wake-up call to stay educated, cautious, and proactive with their money.